August 2025: Stablecoins are for everyone (else): Missing Pieces

There's still so much to build.

Writing that stablecoins are not for Americans helped flesh out some of the pieces I think are missing. If stablecoins are the way that a lot of the world goes onchain, then there are some things I think need to exist that I don’t see in market yet.

Some of the things that are missing

The point of all the background and implications isn’t to say that these things will happen. It’s to outline that the future might have attributes which look extraordinarily different from the attributes we experience today, and it’s not clear that we’re prepared.

Whatever future arrives will require much legislative and policy change, from many governments, and the new/updated social contracts that come with that. But the technology and tools available - to companies, governments and consumers also need to change. I think that to date, the tools available for consumers are by far the most advanced and compelling. Services like Sling, Dolar, Littio, Parallax, Chipper, Plata, BiLira and others (including hyperscale incumbents like Binance & Coinbase) provide consumers as compelling experiences as what they have access to in fiat space, and consumers around the world have far more choices available to them than businesses or governments. I also think the general onchain and stablecoin specific infrastructure layer has really matured. Services like Conduit, HiFi, Checker, Fireblocks, Brale, Stripe/Bridge/Privy, Yellowcard and others enable developers, fintechs, payments providers and traditional financial institutions to interact onchain and around stables in increasingly rich ways. In contrast, the tools for governments and businesses dramatically lag. Here are a couple I think are missing :

Business Banking, completely onchain, targeted at SMBs globally

Technology enabled business banking with a focus on quality experiences for mainstream SMBs around the world, completely onchain. American SMBs already have access to incredibly rich modern banking experiences with companies like Mercury/Brex/Ramp. Europe similarly has Revolut. All these businesses are growing like a weed in fiat space.

Consumers around the world already have access to global digital wallets like Sling, and regional leaders like Dolar are already onchain.

There’s not really an onchain equivalent for SMBs. By this I mean; a super high quality/high craft user experience, built for non crypto native users but utilizing blockchain technology. From what I can tell the core feature set includes

High quality local onramps and offramps: remove the friction of moving in and out of their local currency

Obviated wallet management (customers shouldn’t need to be an expert in wallets, signing etc to be able to do basic everyday tasks that any finance professional performs)

Programmatic instruments & flows:

make it easy to receive funds in your local currency that automatically converts into a stablecoin

Make it easy to initiate payments, payroll, transfers and invoices in your local currency (so that a business can transact locally in their currency with local counterparties without having to worry about conversion)

Make it easy to tradeoff between speed, cost etc for each use case

Multicurrency virtual accounts: enabling a business to have local instrument aliases (eg Account + routing number for the US, Pix Alias for Brazil, IBAN for Europe etc) in all your countries of choice, & handling all the necessary KYC & reporting. This would allow a business to receive payments in the currency/choice of their sender, and control where and how they pay FX. Wise does a really good job of this for consumers in fiat space:

For more crypto sophisticated customers, you can also enable them to choose which stablecoin they hold their treasury in, mint their own coins, and easily convert in and out of other stablecoins along the way. This should help

obviate fear of counterparty risk around something happening to a particular stablecoin issuer

Enable customers to earn the treasury return even when their funds are fairly small scale

Companies like Meow and Dakota are a version of this, but very focused on customers who are already onchain. Otherwise I don’t see many examples of folks building this, but I can’t tell if this is because the concept of an SMB doesn’t exist elsewhere the way it does in the US (with such intense density) or because it does exist and the demand is not there or their needs are shaped differently, or local products in the “global south” countries are just exceptionally good. My current hypothesis is that the big local/regional consumer champions will expand into business accounts as well, and enable SMBs around the world to on-ramp, off-ramp, pay and invoice locally, and manage treasury in stables.

This can exist both as direct to business, or as a platform that local financial services providers can use (think of this as something like Fiserv or Q2, just focused on onchain B2B products). A lot of the tooling to build this exists already in services like Bridge, Privy & Brale - it’s just currently targeted at developers not businesses.

Medium & long duration savings instruments

Most “savings” in stablecoins today are short term or on demand: neither the saver nor the provider or issuer are agreeing explicitly that the saver will hold funds for a fixed period of time. As a result, issuers have to manage their treasuries effectively as a demand deposit: the deposit holder can withdraw their money at any time, and has a reasonable perspective that the funds will be available when they do.

Medium term savings instruments like certificates of deposit (which have a fixed rate and fixed term and a penalty for early liquidation) and long term savings instruments like retirement instruments, pensions and life insurance policies are far more susceptible to being inflated away, than short duration savings instruments like a checking or savings account. With the exception of what Meanwhile is doing, I have yet to see good onchain services enabling long duration saving.

This can be both direct to consumer or as a platform that local insurers or retirement providers can utilize.

Interoperability/backwards compatibility

One “issue” with self dollarization is that even though you can now save in dollars, you still have to convert into local currency in order to use your money. Between when I started this essay and today, several platforms have launched global card issuing including Rain & Bridge/Stripe. These products make it possible for a cardholder who are saving in stablecoins to use existing point of sale infrastructure in their daily life, in their local currency with no additional friction. Cards make stablecoins backward compatible with the fiat world. This doesn’t solve *everything* but is a meaningful improvement over managing the last mile yourself.

Until you’re able to go the everyday last mile; paying your mortgage, utilities, invoices and other base layer financial needs, there will be more to do.

Analytics infrastructure for tracking onchain flows

Services like Dune exist and make onchain data really accessible. Services like Chainalysis enable onchain forensics. What's the equivalent of call reports for stablecoin issuers[1]? If you’re a regulator in any country in the world, do you already have tools to know how much of your citizen’s wealth is onchain or in stables and model how that changes over time, in response to fiscal and monetary policy actions?

This matters less if you believe most onchain behavior is purely speculative. If you believe consumers globally will adopt stablecoins as a way to have access to a stable currency, then as a policymaker you should really care about what the adoption curve in your country looks like, because it literally affects the quality of your policy actions.

In addition, the more of your citizen’s wealth is held in stablecoins, the more you should care about the safety and soundness of stablecoin issuers. At some scale, liquidity or solvency issues with a stablecoin issuer can manifest as a real problem for you/your citizens. [2]

Government Payments Infrastructure

If you think of analytics as a “read” function, that helps monetary policy makers make higher quality decisions, I’m less sure what the equivalent “write” function is. My guess is beyond analytics, monetary policy makers are going to need a slightly different policy toolkit that enables them to interact onchain, manage wallets, secure value, disburse funds, assess taxes & liens etc.

If you’re in a country that’s “self dollarizing”, there’s a business to be built to enable governments to take payment (for taxes, fees, penalties etc) onchain in the citizen’s choice of currency, and convert or store it in the government’s choice of instrument. This will probably be somewhat politically charged, but hard to imagine that making governments more responsive to citizens is a bad thing.

Governments who explore & embrace onchain tools will more quickly understand how onchain dynamics coexist with fiat, and adapt more quickly to discontinuous events.

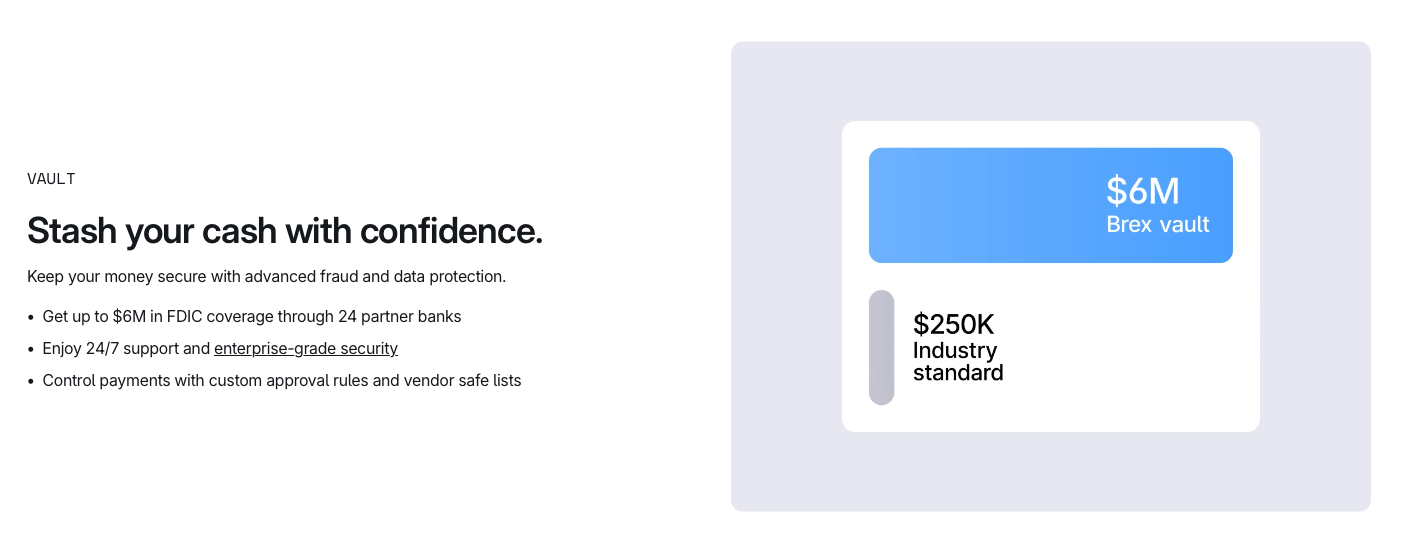

Global, Realtime IntraFi

If you’ve ever used a banking product that offers FDIC insurance on over $250k of balances, it’s likely powered by a brokered deposit or “sweep” network like IntraFi.

Your bank likes these networks because they enable the bank to take on a higher share of your wallet and offer FDIC insurance on more of it. The other banks in the network like it because they get to acquire deposits they can use in various ways. And bank customers like it because they get larger balances insured without opening/managing a ton of bank accounts.

The way Intrafi works today, there are a handful of opportunities globally that I don’t think have been true about the banking system before. First, IntraFi has 2 transfer windows a day (the last one at 3pm ET). In contrast, bank customers largely have access to real time rails and can withdraw funds using various tools around the clock. As a result there’s a mismatch between how fast a customer can withdraw funds, and how quickly their bank can withdraw and settle the deposits from the network. This isn’t a criticism of IntraFi - more a function of where we are on the adoption curve of real time payment rails broadly.

I think generally we’re now in an era (over the last decade) where deposit flight can happen faster than most liquidity cushions can respond (this is likely true for all entities that hold balances including banks, digital wallets and stablecoin issuers).

If you built a brokered deposit network on real time rails (combining stablecoin rails with real time fiat rails like Pix, UPI, Fednow, RTP etc) it would go some way towards solving the problem of a bank experiencing a run being able to keep up with deposit flight on real time rails. Real time fiat rails enable banks to exchange value instantly with other banks domestically, and stablecoin rails enabling banks to exchange value instantly across borders. In an environment where value is exchanged via correspondent banking networks, banks couldn’t exchange value nearly fast enough to solve liquidity problems. Onchain also this is way more possible.

For this to work, a few more questions have to be solved: will financial regulators allow the financial institutions in their purview to extend credit across borders in crisis? Could banks that are highly dependent on brokered deposits for their deposit base be highly susceptible to financial contagion (if all banks in the network recall deposits, its essentially a bank run, but by other banks in the network? Ultimately it might be the case that real time payments constrain fractional reserve banking; basically instant, always on payments can ultimately overwhelm any amount of cushion faster than the bank or issuer can get liquidity. This will mean banks have to keep more capital on balance sheet/lend less, and probably means less credit extended overall. Time will tell.

Global Deposit Insurance Company (GDIC)

Most consumers and businesses have some version of deposit insurance for their deposits in their local currency. If you live outside the US but hold your savings in stablecoins, whats the mechanism for recovering your assets when a stablecoin issuer goes insolvent?

Widespread consumer adoption of stablecoins will most likely require consumers around the world to believe that if something should happen to their issuer, there’s a way they get their money back. GENIUS takes a first step towards this

“Notwithstanding subsection (a), any claim of a person holding payment stablecoins, as defined in section 2 of the Guiding and Establishing National Innovation for U.S. Stablecoins of 2025, issued by a debtor shall have first priority over any other claim against the debtor under this title.”.”

But the FDIC’s reputation as a safeguard for depositors was built over decades of successfully recovering depositors funds after bank failures. We’re only at the beginning of that reputation building for the stablecoin industry.

There’s a lot to build here:

Actuarial underwriting infrastructure; this entity will either have to be privately run, or underwritten by multiple governments, or some combination, as no single government will want to (or have the political support to) do this itself

Onchain reporting infrastructure that enables clear understanding of who held what at the exact point of failure

Automated infrastructure for calculating what core underlying treasury assets remain

Trustless infrastructure for returning them to the end user’s wallets programmatically

If you’re building any of these (or exploring), I’d love to learn more.

[1] I learned while writing this that stablecoin issuers do have call reports. Unlike with banks, they’re private.

[2] Even though both stablecoin holdings (US TBills mostly) and FDIC insurance are in practice backed by the full faith and credit of the US Government, I’ve had enough conversations with large institutional stablecoin holders that indicate they don’t view the two as interchangeable (that they do assign some counterparty risk to the stablecoin issuers when managing their treasury). I can only imagine that governments will do the same.